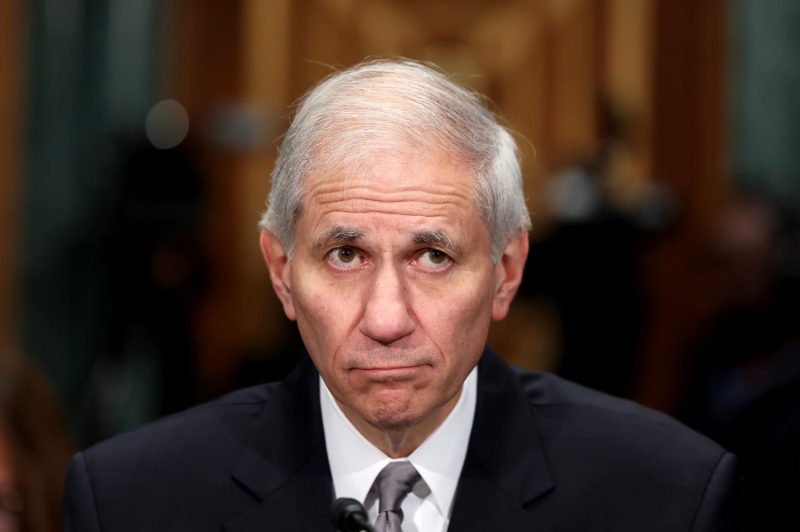

Federal Deposit Insurance Corporation Chairman Martin Gruenberg announced Monday that he will resign, after a recent probe found a widespread culture of sexual harassment and discrimination at the independent agency.

“In light of recent events, I am prepared to step down from my responsibilities once a successor is confirmed,” Gruenberg said in a statement. “Until that time, I will continue to fulfill my responsibilities as Chairman of the FDIC, including the transformation of the FDIC’s workplace culture.”

Sen. Sherrod Brown, D-Ohio, on Monday called on President Joe Biden to replace Federal Deposit Insurance Corporation Chairman Martin Gruenberg after allegations of widespread sexual harassment and misconduct within the agency.

There “must be fundamental changes at the FDIC,” Brown, who chairs the Senate Committee on Banking, Housing, and Urban Affairs, said in a statement. “Those changes begin with new leadership, who must fix the agency’s toxic culture and put the women and men who work there — and their mission — first.”

“That’s why I’m calling on the President to immediately nominate a new Chair who can lead the FDIC at this challenging time and for the Senate to act on that nomination without delay,” Brown continued.

With his statement, Brown broke from fellow Democrats, who have largely condemned the allegations but refrained from pushing for Gruenberg’s resignation, instead calling for him to drive changes at the agency. Brown’s statement could signal the beginning of the end for the FDIC’s top regulator, who was nominated for the position in 2022 by Biden.

Law firm Cleary Gottlieb in April released a scathing report detailing an alleged culture of “sexual harassment, discrimination, and other interpersonal misconduct” at the FDIC.

The 174-page report, which drew from accounts of more than 500 people, also included, in part, allegations of Gruenberg’s short temper, accusing him of engaging in bullying and verbal abuse. Employees described the chairman as “aggressive” and “harsh,” according to the report. In one instance, Gruenberg allegedly screamed profanities at employees after they delivered bad news, the report said.

“For far too many employees and for far too long, the FDIC has failed to provide a workplace safe from sexual harassment, discrimination, and other interpersonal misconduct,” the report said.

Investigators said that while Gruenberg’s alleged behavior is not the “root cause” of misconduct at the FDIC, “we do recognize that, as a number of FDIC employees put it in talking about Chairman Gruenberg, culture ‘starts at the top.’”

The investigators added in the report that “Gruenberg’s reputation raises questions about the credibility of the leadership’s response to the crisis and the ‘moral authority’ to lead a cultural transformation.”

When reached by CNBC, the FDIC declined to comment on Brown’s call for Biden to replace Gruenberg.

Brown did not call on Gruenberg to resign.

Gruenberg on May 15 testified before the House Financial Services Committee, where he apologized for the misconduct at the agency and pledged to implement the report’s recommendations.

Republicans have been quick to call for Gruenberg’s removal following the report’s release, while Democrats have until now been more restrained in their criticism of the chairman, who is also a Democrat.

If Gruenberg were to leave the agency before a replacement is confirmed, it would leave the FDIC’s Board of Directors politically deadlocked with two Democrats and two Republicans, jeopardizing the Biden administration’s financial reform agenda.

According to the FDIC’s bylaws, Vice Chairman Travis Hill, a Republican, would assume the chairman’s responsibilities if the position became vacant.