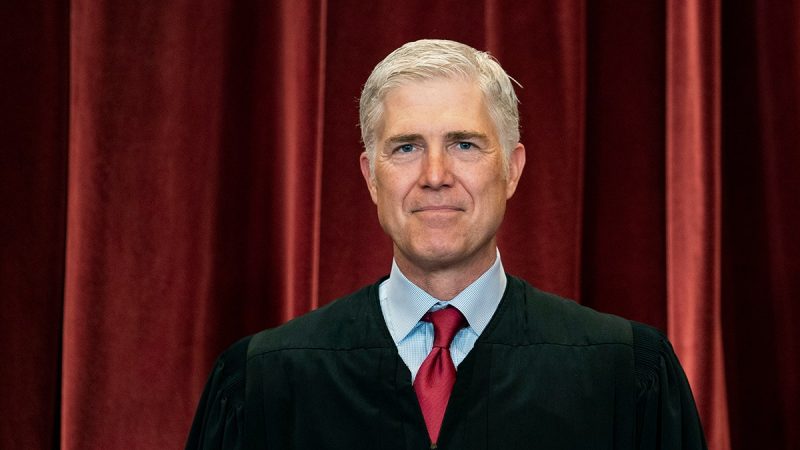

Justice Neil Gorsuch wrote a dissent to the Supreme Court’s decision to limit the U.S. Tax Court’s authority in certain Internal Revenue Service (IRS) cases, asserting that the federal tax collecting service could avoid accountability in the future.

Gorsuch wrote the dissent to the high court’s opinion in Commissioner of Internal Revenue v. Zuch, a case that centers on Jennifer Zuch’s dispute with the IRS that began in 2012 over the agency’s moves regarding her late 2010 federal tax return filing.

‘Along the way, the Court’s decision hands the IRS a powerful new tool to avoid accountability for its mistakes in future cases like this one,’ Gorsuch wrote in his dissent.

In this case, Zuch claimed that the IRS made a mistake, crediting a $50,000 payment to her then-husband’s account instead of her own. The IRS disagreed and sought to collect her unpaid taxes with a levy to seize and sell her property.

Over the years after the dispute began, Zuch filed several annual tax returns showing overpayments. Instead of being issued refunds, the IRS applied these to her outstanding 2010 tax liability.

Once the IRS settled Zuch’s outstanding sum, her liability reached zero, and the IRS no longer had a reason to levy her property.

The IRS then moved to dismiss Zuch’s case in Tax Court, arguing that Tax Court lacked jurisdiction since there was no longer a levy on her property. The Tax Court agreed.

The Supreme Court upheld that Tax Court no longer had jurisdiction without a levy.

‘Because there was no longer a proposed levy, the Tax Court properly concluded that it lacked jurisdiction to resolve questions about Zuch’s disputed tax liability,’ read the high court’s opinion.

The decision will not only prevent Zuch from recouping her overpayments that she believes the IRS has wrongly retained, but give the IRS a way to avoid accountability, Gorsuch wrote in his dissent.

‘The IRS seeks, and the Court endorses, a view of the law that gives that agency a roadmap for evading Tax Court review and never having to answer a taxpayer’s complaint that it has made a mistake,’ the justice wrote.